Focus Activity - Determining a Purpose for Reading

Lesson Outcomes

Outcomes are what you (the student) will be able to do after the lesson is over.

1. I can define historical, political, economic, social, and historical vocabulary necessary to understanding the lesson.

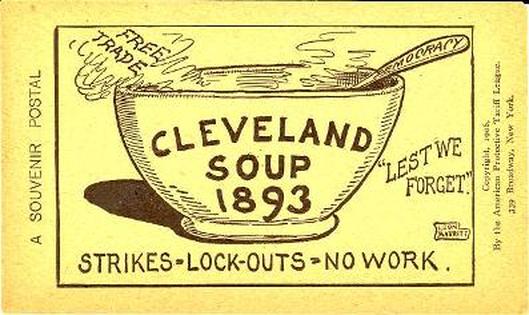

2. I can explain the problems farmers faced in the 1890s.

3. I can show how farmers' problems in the 1890s affected the rest of the country so severely.

4. I can analyze the economic factors of the financial depression in the 1890s.

5. I can evaluate the decisions made about the economy in the 1890s

1. I can define historical, political, economic, social, and historical vocabulary necessary to understanding the lesson.

2. I can explain the problems farmers faced in the 1890s.

3. I can show how farmers' problems in the 1890s affected the rest of the country so severely.

4. I can analyze the economic factors of the financial depression in the 1890s.

5. I can evaluate the decisions made about the economy in the 1890s

Lesson Mission

|

Teaching Activity - Guided Reading

Individual Activity -

Lesson Module 12: Hard Times Pass Off Quiz

Make sure you pass off before October 18th with a 100% to get credit for Lesson Module 12: Hard Times. You have 3 times to pass off. So, make sure you pay attention in class and reread! You may use the reading for pass-offs. Your highest grade is the grade that will be taken.

Reflection Checklist -

Did You Complete Lesson Module 12: Hard Times

Activities for Topic 2 Lesson 12 Module: Hard Times

- Did you read the lesson?

- Did you answer the discussion questions for the Team Activity?

- Did you make a 100% on the quiz?

|

No?

Why Not? Get it done! |

Yes?

Victory is Yours! You have completed Lesson 12 Module: Hard Times. Congratulations! |